What is an egg?

Well, what do you sit on, needs to incubate in a nest, you have to wait for it to hatch, and at its core had some of that sweet gold and silver goop you can lap up if you crack it open early?

Eggs are an investments.

Specifically, they are long-term investments.

That’s why they call retirement funds “nest eggs” because you have to sit on them and wait for them to “hatch”, which means become available at a set time. 401ks, pensions, bonds, and the like all require you to be a certain age in order to break them open and start reaping the rewards.

Shells, themselves, are barriers. Not to dwell on them too long, with crazy esoteric talk of the Qliphoth, I’ll just be brief and have you think of them as “contractual obligations.” Things that bind you to your word, like roots bind a tree to the ground.

Basically, each part of the egg represents a different facet in what we call an investment. Like I said, the shell can be considered an obligation like a barrier that obscures the innards and posits some risk on the investment because you don’t know what’s really going on inside it. The yolk is the nutrient rich nugget that the fetus of the egg consumes for energy, and represents the real time and money you put in, which is worth its weight in gold. The white of the egg is actually the egg’s version of amniotic, which cushions and insulates the fetus as it develops, and represents much of the same assurances that a retirement or investment contract offers you as your investment grows.

Once it is set up, when you lay the egg, you can’t just leave it alone. You don’t have too do much, but you do have to sit on it and wait. Waiting itself is a task too hard for most…

Which is why, if a chicken suspects the egg is not fertile, it will crack the egg open and desperately lick up all the contents to try and recoup the losses. Most of it can’t be recouped, however. This is no different than someone cashing out on their 401k or trading stocks before they are fully developed to try and get something back out of it.

Now, before I convince you too much that it’s only associated with the nature of chickens, I have to say that is not entirely the case. Eggs come in all shapes, sizes, colors, and are parented by various species ranging from fish, lizards, birds, and even plants if you count their seeds as eggs.

All of them, however, represent an investment of time more than resources. You cannot speed up the process, and it doesn’t matter how much you try. You can’t feed the egg anything once it’s laid without destroying the shell and ruining it. With seeds you risk over-watering them and drowning them.

You just gotta sit there and pray.

Hens and Roosters

My point is, you gotta be aware of the process more than just the symbol. Chickens are typically applicable to publicly traded and organized investment opportunities, but there are so many types that it’s hard to list them all. The most ubiquitous are chickens, though, so let’s just keep on that train.

Hens, specifically, are the ones who sit on the nest, rear the chicks, and establish pecking orders with other hens in an effort to keep emotions in the flock stable. Usually, like chatty and gossipy women, it involves a lot of drama. Despite the frustration, they do have their purposes. In other words, hens refer to the subsect of chickens that monitor your investments and do their best to keep everyone calm amidst rumors and gossip of the investment market going sour. If you “have a guy” who helps plan your investment or retirement portfolio, consider that person a hen. Basically, they’re your broker.

Roosters are the ones who crow out all the morning calls. They’re the ones who get up on TV or get on milk crates and shout the current news on Wall Street and Morning Market Calls. Anyone who “offers financial advice” in a public way for all to hear are roosters. A good rooster wakes up early, sees what’s going on with the markets, and then crows as loud as he can for all to hear, saying it’s safe for hens to come and do business on the farm and nip up all the grain and bugs waiting for them while he keeps a keen look out for any predators.

Predators like foxes…

Roosters can also include actors like Jim Cramer. Unfortunately for anyone who listens to him, they’ll soon discover that he’s actually not a rooster, but a fox in disguise. Foxes are con men, and Jim Cramer is simply a fox who has slaughtered a rooster and clumsily draped its bloody skin all over his body. He’s there as part of a larger con job to trick people into investing poorly while also telling the Cabal what to pull out of prematurely. If you do exactly as he says you will lose, but if you listen carefully and pull out on the things he’s overly emphatic about, you’ll be ahead. He’s an example of a fox guarding the hen house.

That’s how the game is played.

Furthermore, to draw allusions to chickens, consider what a coop is.

What does it mean when someone has “flown the coop”?

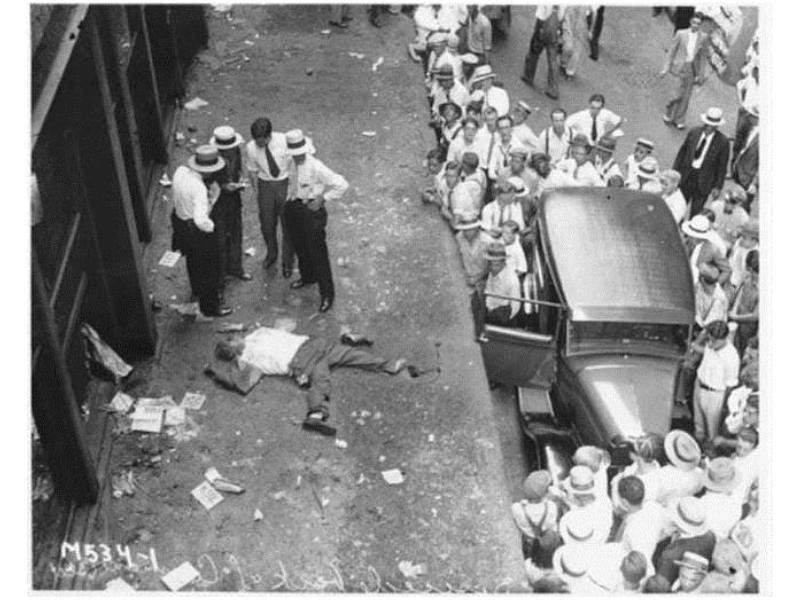

Does the image of chickens flying out of their chicken coop in a craze look like anything else we’ve seen on Wall Street before? Like a bunch of investors all taking the window exit?

When a fox attacks, or the chickens otherwise freak out on their own, feathers go flying, everyone’s in a panic, and some hens are just trying to escape by any means necessary, even if it means jumping out the window. Foxes don’t just kill for food, they’re said to slaughter the whole lot of chickens just for the fun of it.

It’s hectic, and people can’t help but just gawk at the dead bodies and “feathers” everywhere.

The Recent Egg Problems in Comms

Recently, I’m sure you’re aware, there’s been a DRASTIC increase in the price of eggs.

This offers me a good opportunity to demonstrate how Comms HAVE TO, by their rules, reflect reality on both ends.

Which came first, the chicken or the egg?

Was it the egg, or was it the chicken? It’s a paradox.

Basically, that’s the concept. Keep in mind, they use these stories and Comms to send messages about what’s about to happen. It’s insider information, at the end of the day, permitted only for “enlightened” individuals to observe.

So, did the investment market crash because they targeted eggs? Or did the egg prices reflect the market crash?

Did they REALLY kill all those chickens and blame bird flu just for a Comms story!?

Are they that insane?

The answer is, yes…

They are that crazy. They think they can, through Project Looking Glass, alter the future by changing variables in the simulation such that people react a certain way. By disrupting the illusion on the lake’s surface, they temporarily alter our perception of reality and then capitalize on that. They further postulate that the egg market and investment market are entangled not just figuratively, but literally. They believe, like people who sacrifice children to eldritch gods, that if they destroy all the eggs and kill all the laying hens that they can get the stock, bond, and retirement markets to crash or otherwise do what they wish.

There is a good amount of them who wholeheartedly believe that they can do this, like stabbing a voodoo doll with a needle would hurt the person they “entangled” the doll with. In this case, they’ve bound the egg market to the investment market just like a voodoo doll.

So now, when I hear the price of eggs are going up and they are killing off all the hens and blaming it on a non-existent bird flu, it’s not just because they’re evil and they want us to starve while making a fortune on the scare of marked-up eggs. No, no, no… I also hear they have sacrificed those hens and eggs to a false god with the promise that it would bring “rain” or a “fall” of information as it pertains to that particular sphere of influence. In this case, the “rain” they want is a collapse of the financial sector.

Yeah… Crazy, huh?

With this in mind, look up random various articles around the concept of Quantum Entanglement. They aren’t talking about physics, which is why the math never adds up.

String Theory itself is a reinforcement study of Project Looking Glass. Parallel Dimensions and the like are just describing the nature of simulations being used as a means to establish premonition-like predictive algorithms to “game the system.”

In other words, real-life cheat codes.

Why would you slaughter your chickens and artificially raise the price of eggs? How does that crash the investment market directly?

Well, some video game exploits don’t always make sense. Sometimes your seemingly random inputs and events jostle the run-time code, overflow memory, and strange things that go beyond conventional logic can happen. You perform a type of ritual, a glitch, which can change the way the game behaves. The Cabal believes the real world is much of the same, and if you perform certain rituals you can alter reality.

NPCs in the game going about their business look at the “player” strangely, but otherwise are clueless that the odd behavior of the player performing a ritual is actually breaking the code and piecing it back together to suit their aims.

That’s the theory anyways…

It’s up to you to decide if they’re actually achieving the voodoo doll effect or if it’s all make believe. Personally, I’m not convinced either way, and I prefer it like that so I can offer you an honest and fully fleshed out interpretation for both sides.

I'll also mention that Macron's fight over pensions in France peaked recently with him being pelted by an egg.

That was no random chance, and it more of the same Comms. He has "egg on his face" now over his handling of the pension system. The Cabal are not happy with ol' Macron and his embarrassing handling of the task they gave him.